By Ben Hanly, Modern and Contemporary Art Specialist

Download the article here

“Investing in Warhol Is Investing in Art History” (Eric Shiner, Andy Warhol Museum)

The appeal of Andy Warhol’s work is universal and enduring, and it has been the bedrock of the Post War/Contemporary art market for decades, fuelled by his global fame and the rich supply of work. Not surprisingly, his images which were drawn so strongly from popular culture, have come to define our understanding of contemporary art and culture since the 1970s. The art of Warhol is now so mainstream and so inextricably linked to our visual vocabulary that it is impossible not to be familiar with it.

Contemporary art without Warhol is unthinkable, and this influence and popularity is reflected in the strength of his commercial market which has continued to rise on an upward trajectory since his death in 1987.

In many ways the Warhol market defies traditional market rules where perceived wisdom suggests that market strength is linked to the tension between supply and demand – where a limited supply exists, strong prices usually follow. Paradoxically, the opposite is true with Warhol who was a hugely prolific artist. In 1963, Gerald Malanga introduced Warhol to the hitherto commercial technique of silk-screening which he went on to use throughout his career to produce large numbers of canvases produced in various series, as well as extensive numbers of limited-edition prints.

Normally this would be a recipe for commercial disaster. However, with Warhol it turned out to be a strength. Warhol’s notoriety brought him global fame and this coupled with the easy accessibility of his images which have become icons of our time, has meant that there has always been a strong demand for Warhol’s work. The fact that the large supply of works on offer at any one time to collectors has encouraged a very buoyant and vigorous trading market for the artist. Similarly, the fact that collectors can enter his market at varying price points has been very helpful in developing Warhol’s market.

Even today, it is possible to buy a good Warhol limited edition print for as little as £25,000. Whilst this figure might not be exactly small change, it does represent extremely good value and a very attractive entry point level for new collectors entering the market of such an iconic artist. It is hard to believe that a Warhol Campbell’s Soup Can print can be bought at auction for a little as $35,000. The word ‘iconic’ is often used too freely these days, but in this case the use of the word is fully deserved. Warhol’s soup can imagery is truly iconic and for many people it represents what modern art is, so to be able to acquire such an important piece of art history for a relatively accessible price is remarkable.

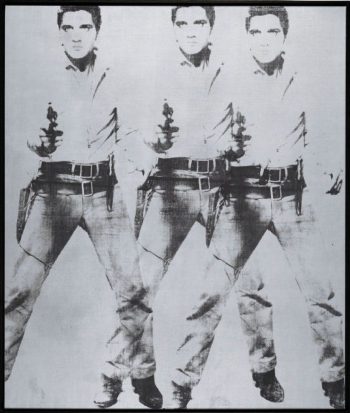

At the other end of his market, Warhol’s major canvases can make staggering sums of money – such as his 1963 Silver Car Crash which made $105m at Sotheby’s in 2013; or his Triple Elvis, also from 1963, which made $82m the following year in 2014. It is not surprising that Warhol’s highest prices have been for his seminal early paintings – here rarity and uniqueness come into play as far fewer works were produced in the early 1960s than in later years, and all of them created with much more hands-on involvement from the Artist himself. It was only in the late 1960s/1970s that Warhol’s studio, his now famous Factory, came into full swing and started to produce large numbers of works with an ever-increasing supply of assistants and helpers. The early works from the 1960s are, therefore, pure Warhol and they are the truly iconic images which were to make Warhol’s reputation – his Soup Cans, Marilyn, Elvis, Jackie Kennedy etc.

A market as diverse and large as Warhol’s performs differently at its different price levels; prints perform differently to canvases, which in turn perform differently depending on date and quality. Clearly the masterworks will always be avidly sought after by major clients and achieve huge prices. However, it is the overall stability and buoyancy that is astonishing with the Warhol market across all sectors.

It is true to say that the value of Andy Warhol’s artwork—despite a brief dip in the 1990s—has been on an endless upward trajectory, and they continue to offer a secure investment opportunity to all levels of collectors. It should be noted that in 2014 alone the value of the international Warhol market sold at auction accounted for $570m – this figure accounted for more than a sixth of the global art market!

Warhol may have famously said that everyone has their 5 minutes of fame, but it appears that thirty-three years after his own death, Warhol’s artwork has a much longer lasting appeal to collectors!